Under US GAAP, entities may choose to present basic and diluted other per-share amounts in the notes to the financial statements, but cash flow per share is not permitted. Additionally, SEC regulations restrict the use of alternative measures of earnings that are considered non-GAAP measures in filings by SEC registrants. In contrast under US GAAP, interim revenue disclosures are the same as annual disclosures for public companies.

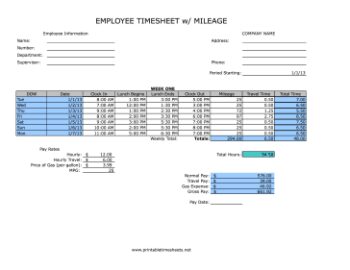

- Complete the reconciliation process for all of your balance sheet’s checking, credit card, and line of credit accounts.

- A financial reporting period that is less than a full financial year (most typically a quarter or half-year).

- Publicly traded companies are required to release interim statements on a quarterly basis, providing investors with updates on how the company is performing and also to keep its financial activities transparent.

- These disclosures include footnotes and other explanations about the financial statements, which otherwise might not be immediately obvious from the financial statements themselves.

- Most accounting software will also let you reconcile loan accounts, as we mentioned in step three.

Interim financial statements to stockholders (external financial statements) will be more condensed than the annual financial statements. Interim financial statements for the company’s management (internal financial statements) will be more detailed, but will omit the notes to the financial statements. A weighted-average rate across jurisdictions is used if it is a reasonable approximation of the effect of using more specific rates. US GAAP uses one overall estimated annual effective tax rate (with some exceptions) to allocate the estimated annual income tax expense or benefit to interim periods. Footnote and other disclosures should be provided as needed for fair presentation and to ensure that the financial statements are not misleading.

#9. Create and print your interim financial statements.

It also specifies the accounting recognition and measurement principles applicable to an interim financial report. Neither US GAAP nor IFRS has made international admissions requirements for adp students filing an interim report a mandatory affair. However, if a company wants they can always hire a professional analyst or accountant for auditing them.

This will inform the recipients that these reports have not been subjected to the same rigorous scrutiny that your yearly financial statements are subjected to each year. The Interim Financial Statements illustrate a six month accounting period beginning on 1 January 2021. The Group produces half-yearly interim financial statements in accordance with IAS 34 ‘Interim Financial Reporting’ at 30 June 2021. An interim report provides information on a company’s performance and position before the year-end so the investors, creditors, and public are aware of the filing entity’s ability or capacity to generate cash flow and revenue. The Interim financial statement should have a condensed statement of the company’s financial position, a condensed statement of profit and loss, cash flows, and selected notes. An interim financial report is very beneficial as it provides a timely view of a company’s operations and financial aspects.

There are no specific standards that need to be followed while preparing these reports. Interim reports come in handy when you want to let the investors, analysts, and shareholders know about your company’s financial performance within a specific period of time. These reports are commonly filed by companies to also highlight the material changes to the general public.

Seasonality Differences

Interim Financial Statements are the financial statements prepared by a reporting entity for a period ending before the last day of the annual reporting period, i.e., less than a year. The government of India has no law on mandatory filing of interim financial reports. The IFRS or International Financial Reporting Standards do not make it mandatory for firms to file an interim financial report, many companies do that either by choice or because of the local regulations. US GAAP requires changes in tax rates enacted in an interim period to be recognized immediately in the interim period of enactment. Often, these interim statements are prepared quarterly, but they may also be prepared monthly or even once every six months. Interim reporting is the publication of financial results for any time shorter than a fiscal year.

We undertake various activities to support the consistent application of IFRS Standards, which includes implementation support for recently issued Standards. We do this because the quality of implementation and application of the Standards affects the benefits that investors receive from having a single set of global standards. By following the above-mentioned points and using an accounting software of your choice, you can easily prepare an Interim Financial Report. Since you will be showing this report to investors, analysts, and other key shareholders, everything should be clear and accurate.

Disclosures

It will also deliver useful insights on the importance and benefits of filing an Interim Financial Report and the process of filing it. This will help you identify any anomalies, like missed or overstated expenses. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

If you’re using an accounting software with bank feed capabilities, this could be as easy as making sure your bank feeds are up to date. But if you also have bills that you pay later—like vendor bills or past-due utilities—you’ll need to enter those bills into the accounts payable section of your software before creating your interim financial statements. Make sure to use the date the bill was issued when you enter it into your accounting system, and not the current date. If you’re a small business owner with no investors, no external shareholders, and no board of directors, you might think interim financial statements don’t apply to your business. But in reality, your business can benefit from interim financial statements even more than larger businesses can—and, chances are, you already receive interim financial statements.

CURRENT BALANCE VS AVAILABLE BALANCE: What’s The Difference?

Small business owners may frequently post an entire loan payment against the loan’s principal amount. However, keep in mind that a component of each loan payment contains interest. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity.

Pininfarina S p A : GROUP – INTERIM FINANCIAL REPORT AT 30 JUNE 2023 – Marketscreener.com

Pininfarina S p A : GROUP – INTERIM FINANCIAL REPORT AT 30 JUNE 2023.

Posted: Fri, 30 Jun 2023 07:00:00 GMT [source]

Keeping a close eye on these two aspects and reviewing them regularly can help you pick out the negative and positive alterations occurring in your company. You will have a more vivid idea of aspects like the total equity, expenses, retained earnings, working capital, cash flow, etc. Generating these reports at least quarterly can provide you with deep insights and benefit your business in ways you can’t even imagine. Having a crystal clear sight of every minute financial detail of your company will yield positive results. An annual report gives the complete and transparent information of a company’s financial position, cash flow, and financial performance. This entire information helps in knowing the results of the management’s ranks and the resources they utilize.

Top 10 differences between interim financial reporting requirements under IAS® 34 and ASC 270.

Unlike the annual financial statements, the interim financial statements will likely be unaudited and either condensed or more detailed depending on the distribution. First, they provide valuable insight into the business’s financial performance. Reading financial statements allows business owners and managers to gain a comprehensive understanding of their financial position. Interim statements provide this overview at any given time, which can help to monitor performance and improve revenue generation and cash flow to successfully grow the company. In the context of accounting cycles, it is the time between these designated reporting periods.

Entersoft S A : Interim Financial Report 30.06.2023 (01/08/2023) – Marketscreener.com

Entersoft S A : Interim Financial Report 30.06.2023 (01/08/ .

Posted: Tue, 01 Aug 2023 07:07:05 GMT [source]

For your interim financial statements to make sense, your profit and loss statement and statement of cash flows must be generated using the same date range. Also, your balance sheet must be produced as of the last date of the same period. To establish their present financial health, most businesses will produce quarterly reports. Interim financial statements include loan statements and supplier bills created in the middle of an accounting quarter.

Participants can choose between the Chinese and English simultaneous interpretation options for pre-registration above. Please note that the English simultaneous interpretation option will be in listen-only mode. Upon registration, participants will receive an email containing conference call dial-in details, event passcode, and a unique registrant ID. Participants may pre-register at any time, including up to and after the call start time. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. EY is a global leader in assurance, consulting, strategy and transactions, and tax services.

Standards to Be Included in the Interim Financial Report

For this step, you will be needing the Daily Report, which is also known as the Z-tape feature of accounting software. It is an option available that helps in correctly entering the sales in the software. If you have enables the ‘pay later’ scheme in your business then the open invoices should also be mentioned in the receivable section of the accounting software you are using. © 2023 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. An appendix to IAS 34 provides guidance for applying the basic recognition and measurement principles at interim dates to various types of asset, liability, income, and expense. Billie Anne started Pocket Protector Bookkeeping in 2012 to provide an excellent virtual bookkeeping and managerial accounting solution for small businesses that cannot yet justify employing a full-time, in-house bookkeeping staff.

Luckily, accounting software makes interim financial statements easy to prepare. The thought of creating interim financial statements for your small business might be daunting, but it doesn’t have to be—your accounting software can do much of the heavy lifting for you. Reviewing interim financial statements is extremely important for small businesses. Whereas large corporations can often recover from a bad year, that bad year—or even a bad quarter—can spell disaster for a smaller business. Waiting until the end of the year (or worse, the end of tax season) to review your financial statements and identify problems within your business can make those problems much more difficult, or even impossible, to overcome. And while interim financial statements should be transparent, they still don’t require the full disclosures that annual financial statements do.