The amount of money you can use which have a house Equity Mortgage was mostly based on the guarantee you really have on the home – the business property value your property without people a good mortgage harmony.

Extremely lenders allows you to use doing 85% of one’s home’s appraised well worth, minus your own outstanding financial equilibrium. Such as, in the event the house is well worth $350,000 while nevertheless owe $two hundred,000 on your home loan, you could be eligible for a property guarantee financing as much as $97,five-hundred ($350,000 x 85%, without $two hundred,000).

not, understand that the very last loan amount together with hinges on other variables like your money, credit history, and you may market criteria.

Knowledge Family Guarantee Loan Conditions

- Adequate Equity: As mentioned prior to, very lenders allow you to obtain around 85% of your house’s value without everything still are obligated to pay on the financial.

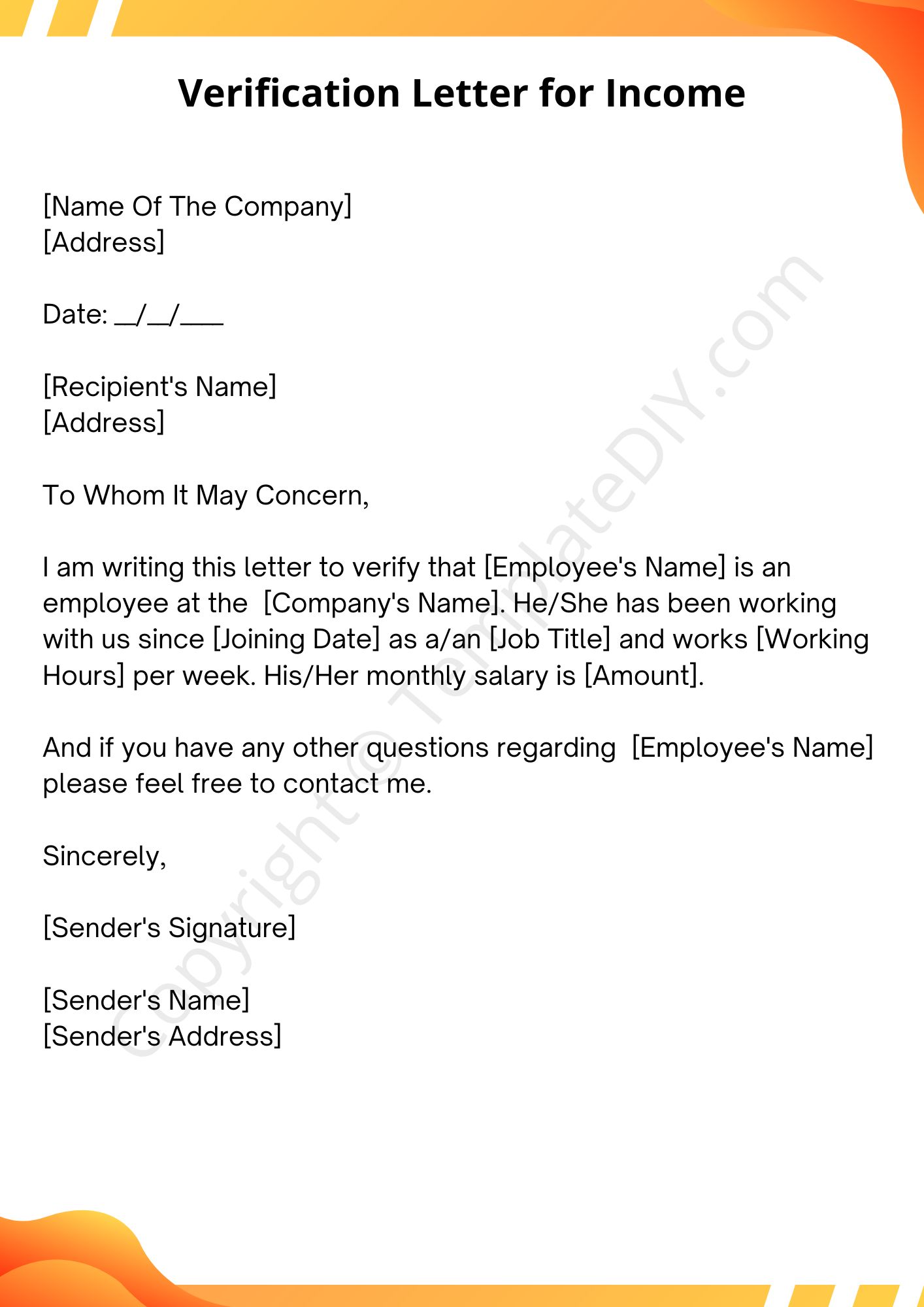

- Stable Earnings: Lenders look at the money to locate whenever you can see the payment obligations.

- A good credit score Rating: A good credit score suggests reduced chance for the loan providers and you can thus, escalates the threat of the loan being qualified and just have bagging a far greater interest rate.

It’s important to understand that such criteria can vary slightly among loan providers. Often be certain to read the certain criteria with various loan providers before applying.

The way to select an educated Home Equity Mortgage

- Comprehend the can cost you: Like your first financial, you’ll be able to shell out settlement costs and you will costs to the a home collateral loan. See all of these charge ahead of committing.

- Store and you will Compare: Examine numerous lenders and you may examine their interest pricing, and you can terms and conditions to discover the best fit.

- Take a look at the conditions and terms: Be cash advance certain that you’re completely aware of every words and you can conditions of your own mortgage. In the event the something was undecided, don’t hesitate to make inquiries.

I don’t have a one-size-fits-all the Home Security Mortgage. The correct one is but one that suits a monetary requires and affairs.

Faq’s Regarding House Collateral Fund

When it comes to Home Equity Funds, a couple of questions frequently occur again and again. Let’s mention and you can respond to such common question:

Property equity mortgage gives you a lump sum of currency that’s repaid over a predetermined name. At the same time, a home equity personal line of credit (HELOC) provides you with a personal line of credit to draw off as required, like a credit card.

Obtaining a house equity loan is also briefly reduce your borrowing get because relates to a painful query to your credit score. However, for people who obtain responsibly and work out your instalments timely, property security loan will help replace your creditworthiness throughout the years.

Check out the interest rate, the size of the term, upfront costs eg closing costs, and you may costs. Along with, make sure to have a clear knowledge of the fresh conditions, specifically whether the interest is fixed or adjustable.

When you find yourself struggling to create your financing repayments, get in touch with your own bank instantaneously. These are typically capable work out a changed commission bundle. Reduce within the communication you may put your home vulnerable to foreclosure because it is security for the mortgage.

The answer relies on your situation. If you have a great speed on your own existing mortgage, a property equity loan might be best. Simultaneously, in the event the financial rates enjoys fell because you ordered your residence, a profit-aside re-finance might possibly be a much better alternative. Consult an economic mentor to help make the greatest decision.

Yes, property collateral mortgage is smart for many who has a large, one-big date expenses, and you have built up way too much equity in your house. You have got to make sure you feel the way to repay it versus reducing debt fitness.

- Reduction of household well worth: If the worth of your residence minimizes, you could find yourself due more on your property than it is value.