Individual Right up Group

Individual Right up try an actually stored, Boston-dependent fintech startup that’s with the a goal to ensure every household visitors receives a reasonable package to their home loan of the unconditionally strengthening people who have tailored data, customized pointers, and you may unprecedented usage of mortgage lenders which will make top economic outcomes and clarify our home financing sense.

Louis stated that this new delinquency rates towards mortgages to have a single-family home is dos.49%. This isn’t much, however for lenders, extent on the line was higher since residents usually spend several from several thousand dollars to own a house otherwise condo. Knowing the borrower pays right back the mortgage is critical.

Millennials make up the biggest show off homebuyers at 37% and are usually together with disproportionally basic-date homeowners. To possess more youthful millennials decades 21 to twenty-eight, 86% are very first time homebuyers as well as for older millennials decades 30 so you can 38, 52% was first-time home buyers. Lenders you prefer a jobs confirmation way to guarantee these individuals, and all sorts of anybody else, have the money to invest right back home financing that may most likely become its biggest monthly bill.

A main way to do this is by using employment verification, that’s an everyday financial needs. A career verification involves papers and additionally paystubs, tax returns, W2s and you may choice forms of verification instance a written Verification from A career (VOE) to assess a beneficial borrower’s a job history.

Employers commonly expected to complete created VOE variations out of mortgage lenders as part of the employment verification process, but the majority take action since it gurus teams. Businesses might require written agree away from employees just before providing created confirmation.

Earnings Verification Techniques

The house to find process comes with of a lot tips, although head a person is home loan underwriting where in actuality the bank analyzes an excellent borrower’s ability to spend. The first investigations are automatic and you can analyzed according to records filed. They is designed to be sure particular info and talks about three head areas:

- Credit: Your credit score reflects people foreclosures otherwise bankruptcies, the new updates out-of revolving fund and you will one outstanding debts.

- Capacity: Capability focuses primarily on the debt-to-money proportion (DTI), that’s discussed below in more detail and you can suggests when you yourself have a workable number of personal debt.

- Collateral: Collateral examines your deposit amount as well as the assets youre looking to purchase observe exactly what chance you twist out of defaulting.

Main to all of those assessments is your a position background getting new preceding 2 years. To have salaried individuals, which work confirmation is performed because of spend stubs, tax statements and you may W2s. For care about-working consumers, the list is offered and boasts taxation statements and you will 1099 models also profit-and-loss comments. Such lender needs are typical financial standards, in addition to lender statements.

This action to confirm money is first completed by the computers and you will uses automated underwriting options. They commonly introduces warning flag or parts needing more information. To date, manual underwriters dominate to research every piece of information and request most money verification files.

Authored Confirmation from A job (VOE) Told me

Whenever W2 earnings recommendations having salaried team provided with W2s was shortage of, lenders tend to demand a created VOE included in the work confirmation procedure. In place of W2s, shell out stubs and https://elitecashadvance.com/installment-loans-mi/ you may taxation models, that it must be finished from the a recent or prior employer.

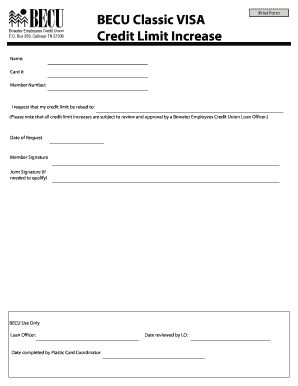

The composed VOE, or Federal national mortgage association VOE Form 1005, comes with information about go out away from hire, cancellation time (if relevant), compensation and payment construction (bonuses, commissions). It may additionally include details about the chances of continued work in the event the a career status is a problem, day and amount of 2nd spend improve, and you will reasons for having making. If it details is provided, it must be considered as area of the income and employment analysis.

The brand new document need to be computer made or published by borrower’s manager. It may be filled out because of the Hr agency, staff workplace, payroll department, external payroll seller, or a good borrower’s current or previous manager. Self-employed individuals do not use an authored VOE and you will rather provide income tax files to ensure income.