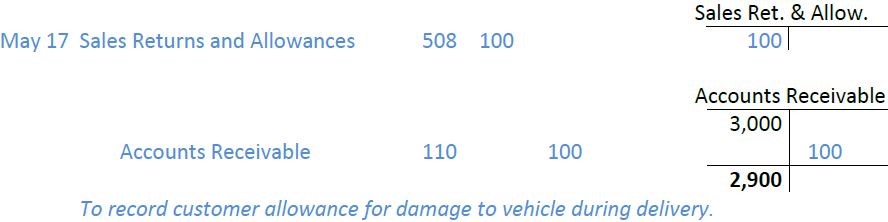

An allowance is similar to a return in the fact that the seller is giving the buyer a credit on the account because something is wrong with the order. In the case of an allowance, the physical inventory is not returned to the seller. The buyer gets to keep the merchandise but receives a discount on what happens if you can’t pay your taxes the merchandise. Sometimes this happens because the inventory is incorrect but the buyer thinks it can still be sold. Maybe it was the wrong color or maybe there is slight damage to the product but it can still be sold at a discount. Now, let’s look at the entry from Whistling Flute’s perspective.

Journal Entry under Periodic Inventory System

For most companies, purchases include goods purchase, which then they resale or use in manufacturing. Once companies purchase goods, they require them to be of good quality to produce or sell further. Therefore, companies may return the goods or ask for allowances from their suppliers. As you can see, under the perpetual inventory system the merchandise inventory reduced by $100. The following video summarizes how to journalize purchases under the perpetual inventory system.

Purchase Return Bookkeeping Entries Explained

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- Let us understand the advantages of cash or goods purchase return journal entries through the points below.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- Despite the advantages mentioned above, there are a few factors that prove to be a hassle.

We learned shipping terms tells you who is responsible for paying for shipping. FOB Destination means the seller is responsible for paying shipping and the buyer would not need to pay or record anything for shipping. FOB Shipping Point means the buyer is responsible for shipping and must pay and record for shipping. Purchases Returns would have been credited (since it is a company expense decrease). The main reason for not deducting it directly from purchases is to keep the accounting records properly maintained for auditing and internal controls.

Trial Balance

Maria Trading Company always sells goods to its customers on account. The company collects sales tax at 7% on all goods sold by it and periodically sends the collected amount of tax to a tax-collecting agency. Cash and Merchandise Inventory accounts are current assets with normal debit balances (debit to increase and credit to decrease).

Table of Contents

Therefore, ABC Co issues a debit memorandum and returns such goods back to its supplier with a value of $100. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the revenue account from the initial purchase. You must debit the Sales Returns and Allowances account to show a decrease in revenue. In most cases, the customer receives a refund when they physically return the good.

However, the purchase returns account will get replaced with the allowance account. The purchase returns and allowances accounts exist due to the accruals concept in accounting. When companies incur an expense, this concept requires them to record it. It does not need a cash settlement to become eligible for recording.

Instead, we use Purchases and the contra accounts related to Purchases. Since we are now discussing returns and allowances, can you figure out what account we will use? Most of the time in accounting, the account names describe what is going on. So let’s look at the entry for the same transaction under periodic inventory. Therefore, ABC Co. returned those goods to the relevant suppliers.

On April 7, CBS purchases 30 desktop computers on credit at a cost of $400 each. On April 1, CBS purchases 10 electronic hardware packages at a cost of $620 each. When using the periodic method, the entries for allowances are the same as entries for returns because we do not track inventory under the periodic method.

Purchase returns are goods that a company returns to its suppliers due to various reasons. Similarly, purchase allowances are discounts received for goods already recorded in the accounts. Both of these accounts represent a reduction in a company’s purchase expense. The above explanation provides a basis to record purchase returns and allowances. As mentioned, these transactions do not impact the purchases account. Nonetheless, it is crucial to understand how a company records the purchase of products or services.